supportdap.online

Prices

Defaulted Payment

This notice is sent because the Department has placed the taxpayer's Installment Payment Agreement in a default status. The taxpayer should take one of the. Notice of default, contents, form, delivery. — 1. After a borrower has been in default for ten days for failure to make a required payment and has not. You may get a default notice or 'notice of default' if you miss or do not make agreed payments. This is recorded in your credit file and can affect your credit. If you entered into a written Installment Agreement to reinstate a suspension for an Unsatisfied Judgment and you fail to make the required payments – you will. The prior year secured tax roll closed on July 1st. We are currently accepting payments for unsecured, defaulted, and carryover supplemental bills. For most federal student loans, you will default if you have not made a payment in more than days. You may experience serious legal consequences if you. First Payment Default (FPD) is a term used to describe a situation where a borrower fails to make their first payment on a loan. Read more. Change your default payment method · Open the Google Wallet app. · At the top, on your card, swipe from the right edge of the screen until you find the card. This site will provide you with accurate information and assistance to help resolve defaulted loans or grants assigned to the Department's Default Resolution. This notice is sent because the Department has placed the taxpayer's Installment Payment Agreement in a default status. The taxpayer should take one of the. Notice of default, contents, form, delivery. — 1. After a borrower has been in default for ten days for failure to make a required payment and has not. You may get a default notice or 'notice of default' if you miss or do not make agreed payments. This is recorded in your credit file and can affect your credit. If you entered into a written Installment Agreement to reinstate a suspension for an Unsatisfied Judgment and you fail to make the required payments – you will. The prior year secured tax roll closed on July 1st. We are currently accepting payments for unsecured, defaulted, and carryover supplemental bills. For most federal student loans, you will default if you have not made a payment in more than days. You may experience serious legal consequences if you. First Payment Default (FPD) is a term used to describe a situation where a borrower fails to make their first payment on a loan. Read more. Change your default payment method · Open the Google Wallet app. · At the top, on your card, swipe from the right edge of the screen until you find the card. This site will provide you with accurate information and assistance to help resolve defaulted loans or grants assigned to the Department's Default Resolution.

First Payment Default (FPD) refers to the failure of a borrower to make the initial payment on a loan or credit agreement. Define Default on Payment. means failure to pay a Debt or its instalment when due as stated in the Securing agreement. After default, you have 60 days to establish satisfactory repayment arrangements. Failure to make a payment, or enter into a satisfactory repayment. See below for additional information. Federal law defines default as days past due. Defaulted loans are not eligible for deferments, lower payment options. In finance, default is failure to meet the legal obligations (or conditions) of a loan, [1] for example when a home buyer fails to make a mortgage payment. Default on a Federal Family Education Loan Program (FFELP) Loan occurs when you fail to make payments, and your loan reaches days of delinquency. The annual list of property which is "Tax Defaulted" at the end of the fiscal year (June 30) is published on or about September 8 of the year following tax. Past due on mortgage, auto or student loan payments? Here's what you need to know about loan delinquency and default to avoid a damaged credit score. Default refers to a company or individual who fails to make payments or interest payments on time. It typically applies to loans taken from a bank or provider. What is a default of payment? A default of payment means an invoice that has not been paid on time by a debtor. An invoice is therefore considered unpaid when. You can make payments online, view payment history, download tax forms, send defaulted student loans. If you are looking for information related to. Change your default payment method · Open the Google Wallet app. · At the top, on your card, swipe from the right edge of the screen until you find the card. Generally you have a grace period of up to 30 days to pay on a credit card or other personal loan, but in some cases missing a payment by even one day can cost. Important Terms · Delinquency – A late or missed interest (or principal plus interest) payment. · Default – A default is triggered by an event or by a change in. Even though student loan payments have restarted, all wage garnishments remain cancelled. If your employer has garnished your paycheck, it was done so without. Case Name: Important: If you disagree with a judgment creditor's Declaration of Default in. Payment of Judgment (form SC), you. Notice of default, contents, form, delivery. — 1. After a borrower has been in default for ten days for failure to make a required payment and has not. Payment delinquency is commonly used to describe a situation in which a borrower misses their due date for a single scheduled payment for a form of financing. A debtor must pay a contractual default rate of interest to cure and reinstate a lender's prepetition claim.

Cd Rates Vs Savings Account

:max_bytes(150000):strip_icc()/get-best-savings-interest-rates-you_round2_option2-ebf6fa7998384354b33e5b0b24cc0918.png)

You can't withdraw the money in a CD for a set amount of time without a penalty whereas a HYSA you can withdraw whenever it just takes a couple. Potentially higher interest rates: CD accounts may offer better interest rates compared to savings accounts, particularly for longer-term CDs. Fixed-rate CDs. CDs usually offer higher rates of interest than savings accounts. Savings accounts offer some of the lowest rates of any investment. · A savings account keeps. CDs typically offer higher interest rates than savings accounts and Money Market Accounts, but the tradeoff is that you cannot access your funds until the CD. Money market accounts have lower interest rates than CDs, but they also offer more flexible terms and easier access to your cash. At WaterStone Bank, your money. For CDs, the change will occur upon renewal. To receive a disclosed Relationship Interest Rate/Relationship APY, the eligible savings account or CD must remain. High Yield Savings Accounts A high yield savings account is a type of savings account that earns a higher interest rate compared to traditional savings. If you need quick access to your money, a savings account is the best bet, as you can withdraw funds at any time. In contrast, CDs usually come with early. Pro: CDs tend to have higher APYs than traditional savings accounts. · Con: You'll likely pay a penalty for making an early withdrawal. · Pro: Your savings will. You can't withdraw the money in a CD for a set amount of time without a penalty whereas a HYSA you can withdraw whenever it just takes a couple. Potentially higher interest rates: CD accounts may offer better interest rates compared to savings accounts, particularly for longer-term CDs. Fixed-rate CDs. CDs usually offer higher rates of interest than savings accounts. Savings accounts offer some of the lowest rates of any investment. · A savings account keeps. CDs typically offer higher interest rates than savings accounts and Money Market Accounts, but the tradeoff is that you cannot access your funds until the CD. Money market accounts have lower interest rates than CDs, but they also offer more flexible terms and easier access to your cash. At WaterStone Bank, your money. For CDs, the change will occur upon renewal. To receive a disclosed Relationship Interest Rate/Relationship APY, the eligible savings account or CD must remain. High Yield Savings Accounts A high yield savings account is a type of savings account that earns a higher interest rate compared to traditional savings. If you need quick access to your money, a savings account is the best bet, as you can withdraw funds at any time. In contrast, CDs usually come with early. Pro: CDs tend to have higher APYs than traditional savings accounts. · Con: You'll likely pay a penalty for making an early withdrawal. · Pro: Your savings will.

CDs are deposit accounts that require you to set aside money for a fixed period in exchange for a fixed interest rate. While savings and MMAs are variable rate. CD vs. Savings Account: Pros and Cons Savings accounts. You can easily withdraw your money at any time without penalty. (Certain restrictions apply based on. For guaranteed earnings: CDs · How they work: A Certificate of Deposit is a type of savings account that earns a fixed interest rate for a set period of time. Money market accounts and CDs typically have higher interest rates than savings accounts. · With a CD, your money is locked away for a set time, such as CDs and savings accounts are two types of deposit accounts that earn interest. · CDs park your money for a set period. They pay higher rates but come with. Vio Bank offers CDs, High Yield Savings and Money Market accounts with some of the best rates in the nation, allowing you to save smart and earn more. However, CDs generally allow your savings to grow at a faster rate than they would in a savings account. Compounding interest: Interest Rate vs. APY. Best CD rates of August (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Synchrony Bank — 3 months. To achieve your savings goals, it's best to put your money to work earning interest in either a high interest savings account or Certificate of Deposit (CD). To. A CD usually gives a fixed interest rate over its entire term. A savings account can adjust its rate whenever it wants. So an 18th month CD. The biggest difference between a CD and a savings account is that CDs can pay more interest, but you can't access your funds without penalty. What Is a CD? A CD. Short for certificate of deposit, CDs tend to offer higher APY's compared to high-yield savings accounts. But there's a catch: Your money must stay locked up in. 4 is going to a CD. How is a CD different from a traditional savings account? A CD is a savings account that typically earns a higher interest rate because you. Savings accounts offer more liquidity, allowing you to deposit and withdraw funds freely. At the same time, CDs require you to deposit a specific amount for a. The interest rate of a traditional savings account is extremely low, usually only % APY. This means that if you kept $10, in a savings account for a year. A CD is better because it pays more but the downside is you can't touch it till maturity. At some point, they will likely cut rates. If they cut. All CDs must be funded within 60 calendar days from the time we approve your application or will be subject to closure. The interest rate and Annual Percentage. Credit union members or bank customers earn interest on the total deposited amount, and fees are applied if the cash is withdrawn early. The longer the money. A high-yield savings account (HYSA) is very similar to a traditional savings account, but a HYSA gives you the opportunity to earn a higher yield — meaning your. Fixed-term CDs are typically considered less liquid than a high-yield savings account, with funds subject to early withdrawal penalty fees when accessed prior.

Real Or Fake Scanner

Scanning the barcode doesn't guarantee authenticity. A fake pop can still pull up a listing when its barcode is scanned into the app. QR Codes and Security: Stay Safe when QR Code Scanning | Signs of Fake QR Codes reality. How do I scan QR codes? Most smartphones have built-in QR. There isn't any way of knowing if the product is genuine by simply scanning the QR Code or barcode. People counterfeiting a product can simply paste the QR. Money Buster 3D: Fake or Real 12+. Detect fake cash and have fun Scan it!!Supermarket Simulator. Games. Cut and Paint. Games. The failure rate for selling to minors in the US is about 15%. When the local authorities test you, they test with a real minor with a real underage ID. Using. How to tell if your Pokemon cards are real or fake! #fyp #viral #trending #smallbusiness #fypage #pokemon #pokemoncards #business #money #pokemontiktok. Scanning a malicious or fake QR code can lead to financial losses, your device getting hacked, or even identity theft. Finally, use common sense when scanning QR codes. If something seems too good to be true or doesn't make sense, it's probably a scam. Scammers. QR & Barcode Scanner app is the fastest QR code scanner / bar code scanner out there. QR & Barcode Scanner is an essential QR reader for every Android device. Scanning the barcode doesn't guarantee authenticity. A fake pop can still pull up a listing when its barcode is scanned into the app. QR Codes and Security: Stay Safe when QR Code Scanning | Signs of Fake QR Codes reality. How do I scan QR codes? Most smartphones have built-in QR. There isn't any way of knowing if the product is genuine by simply scanning the QR Code or barcode. People counterfeiting a product can simply paste the QR. Money Buster 3D: Fake or Real 12+. Detect fake cash and have fun Scan it!!Supermarket Simulator. Games. Cut and Paint. Games. The failure rate for selling to minors in the US is about 15%. When the local authorities test you, they test with a real minor with a real underage ID. Using. How to tell if your Pokemon cards are real or fake! #fyp #viral #trending #smallbusiness #fypage #pokemon #pokemoncards #business #money #pokemontiktok. Scanning a malicious or fake QR code can lead to financial losses, your device getting hacked, or even identity theft. Finally, use common sense when scanning QR codes. If something seems too good to be true or doesn't make sense, it's probably a scam. Scammers. QR & Barcode Scanner app is the fastest QR code scanner / bar code scanner out there. QR & Barcode Scanner is an essential QR reader for every Android device.

scanning QR codes or Barcodes. Verify Original or Fake Products. circle. Confirm original products by scanning the product's QR code. If your device cannot scan or read the QR Code produced, that calculator may possibly be a counterfeit model. FAKE QR CODE. STEP 3. Manual of ClassWiz will be. These scams work because fake checks generally look just like real checks, even to bank employees. They are often printed with the names and addresses of. Why should I care if something is real or fake? Fraudulent products harm For Pixel 6 and later phones, you can scan the QR Code on the phone box to. The portable scanner is able to compare any manuscript to a vast database and uncover, in just a few minutes, whether something is real or fake. Real-time Scanning: When a product is scanned, extract The detection outcome indicates whether the scanned product is classified as genuine or fake. Actually, scanning a fake might work if it's just for your personal inventory or fun. But if you're trying to verify its authenticity or add it to an. When holding a card that you believe may be a fake card, feel the surface of the card. Compare it with a card you know to be genuine. Does the card in question. Discover Fake Image Detector, a powerful tool for detecting manipulated images using advanced techniques like Metadata Analysis and ELA Analysis. A fake scanimage that uses real images from an experiment as output - Scan Fake Scanner. This is a docker image that is used to create a fake. The blue used is also a Pokemon signature. Many fake cards will look like they have faded backs, and this is easily noticeable on the borders. If when using a reader or scanner the code cannot be deciphered, we will undoubtedly be facing an error. Another option is that, when reading the black and. FPS is a mobile app that allows the manufacturer to track their products. The project uses the blockchain technology to identify fake products. Fakespot protects you from getting ripped off when shopping online. Join the secure shopping revolution and get the the truth about products, reviews. Verify your ELFBAR product to ensure that it's genuine. Fake and counterfeit vape products can be dangerous and harmful to your elf. Use our online tool to. To scan a security label, simply open the app CheckIfReal will automatically determine authenticity, and confirm if you have a real or a fake product. Next, check the hexagon. If there is no Lot Number and/or a different font type is used compared to the one shown below left, it's not an original product. Unlike the counterfeits, all EOTECH holographic weapon sights are made in the U.S.A.. Often the differences in appearance between the Genuine EOTECH products. On fake cards, the blue swirling design often looks purplish. Also, sometimes the Poké Ball is upside down (on a real card, the red half is on the top). As a club owner that deals with fakes this app is really helped us out, and we love his features. A feature that we would love to see is that the club can.

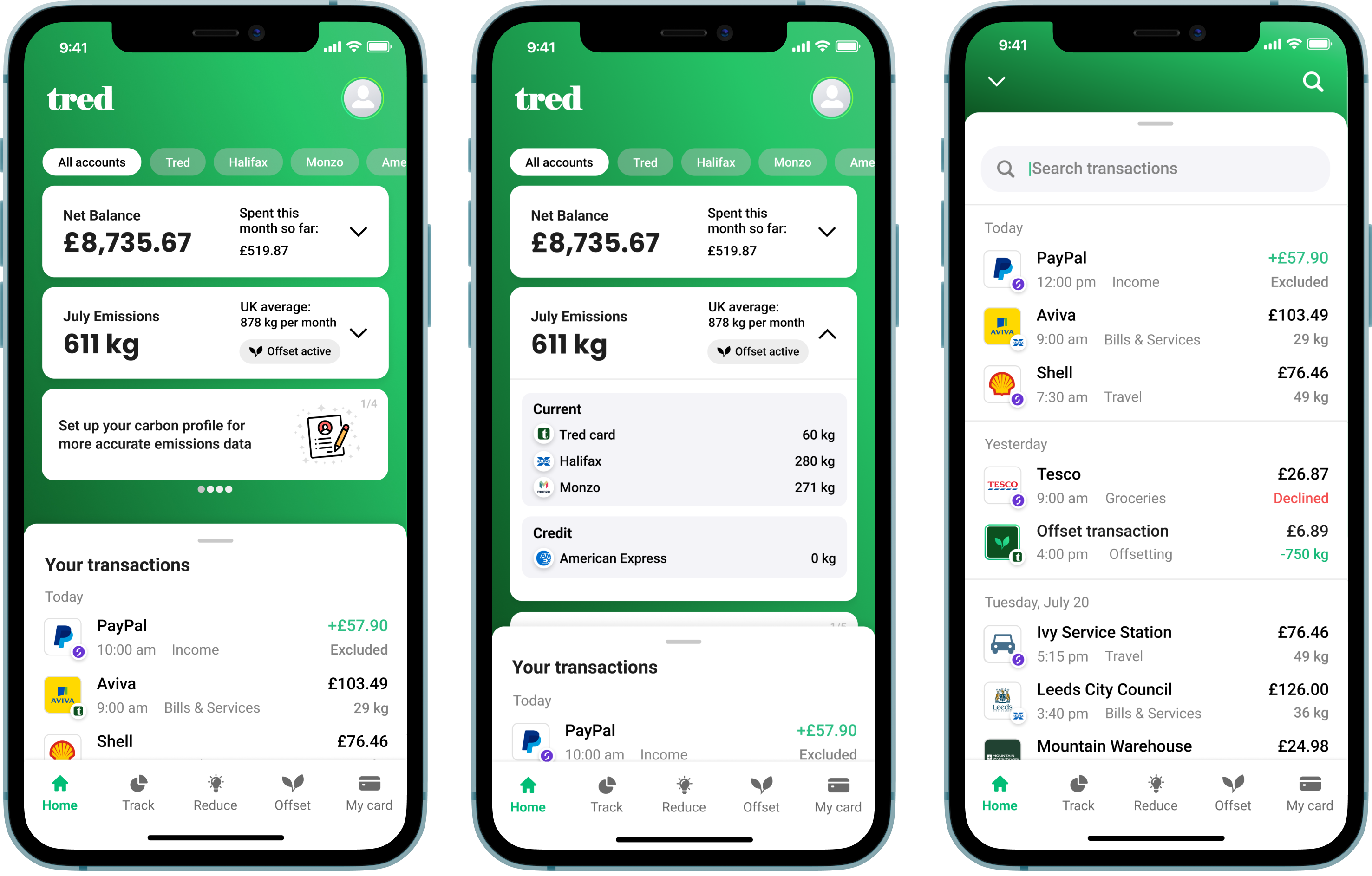

Best App For Tracking Bank Accounts

The best expense tracker app for investors is Empower because you can view all of your investment and bank accounts in one app. It gives investment tools. Emma Pro offers unlimited bank logins, and features such as the ability to track your net worth over time, custom categories and you track your spending in any. Empower is a budgeting and net worth tracker all in one, making it the perfect choice if you want an investment tool that tracks both your spending and wealth. PocketGuard is an all-in-one budgeting app that lets you sync every bank account, credit card, loan, and investment account you have to better understand your. 1. Mint Personal Finance & Money · Log in to your bank account. This may take several minutes. · Once you've. The best budget app not connected to a bank account is Goodbudget. This budgeting app uses the envelope system for budgeting and doesn't require linking to your. Staying organized: The best apps for money management · Simplifi by Quicken · Zeta Money Manager · PocketGuard · Albert · YNAB (you Need A budget) · Personal Capital. NerdWallet: Manage Your Money 4+ · Track Credit, Budget & Finance · NerdWallet · iPhone Screenshots · Additional Screenshots · Description · What's New · Ratings and. This app app is great! It has many features to help organize and track income and expenses. This app has everything the other budgeting apps have and more. The best expense tracker app for investors is Empower because you can view all of your investment and bank accounts in one app. It gives investment tools. Emma Pro offers unlimited bank logins, and features such as the ability to track your net worth over time, custom categories and you track your spending in any. Empower is a budgeting and net worth tracker all in one, making it the perfect choice if you want an investment tool that tracks both your spending and wealth. PocketGuard is an all-in-one budgeting app that lets you sync every bank account, credit card, loan, and investment account you have to better understand your. 1. Mint Personal Finance & Money · Log in to your bank account. This may take several minutes. · Once you've. The best budget app not connected to a bank account is Goodbudget. This budgeting app uses the envelope system for budgeting and doesn't require linking to your. Staying organized: The best apps for money management · Simplifi by Quicken · Zeta Money Manager · PocketGuard · Albert · YNAB (you Need A budget) · Personal Capital. NerdWallet: Manage Your Money 4+ · Track Credit, Budget & Finance · NerdWallet · iPhone Screenshots · Additional Screenshots · Description · What's New · Ratings and. This app app is great! It has many features to help organize and track income and expenses. This app has everything the other budgeting apps have and more.

We already know that QuickBooks is one of the most popular accounting software solutions for entrepreneurs, and the company's app for expense tracking is also. Best Savings Account Interest Rates of September · Best CD Rates of September · Best Banks for Checking Accounts · The Balance · Best Auto Loan Rates. Starling: Budgeting help + top overseas · Monzo: Spending notifications + budgeting help · Revolut: Good option for frequent travellers. Like PayPal, which owns Venmo, the app is a virtual wallet that can link bank accounts and credit cards. Unlike PayPal, any linked bank account has to be in the. Connect your bank accounts to track expenses automatically and know where every dollar is going. Dive into in-depth reports on your spending and cash flow. Award-winning products. Our No Fee Chequing Account and Cash Back Visa* Card have been selected as some of the best offers in the market. Why use Snoop? · See all your bank accounts together · Pay less for your bills · Track where every penny goes · Set an instant budget in two taps · Save where you. EveryDollar utilizes zero-based budgeting for easy-to-use budget tracking through the free mobile app. The app doesn't allow you to sync bank accounts within. Frollo · Sync from Australian bank accounts – including superannuation and investments. · Automatic categorisation for transactions. · Set savings goals and. Keep track of your accounts, analyze your spending, and create a budget with GreenBooks. It's a Quicken alternative for Mac. NerdWallet is our favorite totally free app. It combines bank account imports and transaction management with excellent information about your credit score. It. Everydollar. Simplifi. SupportPay. Center Expense. Digits. Shoeboxed. Expensify. Xero. Your banking app. 6. Best for You and Your Financial Adviser: Monarch While some budgeting apps help you stay on track with your partner, Monarch lets you team up with your. Available for iOS and Android users, the Mint budget app allows you to link up your bank accounts and monthly bills to create a budget, and it suggests ways to. From the Mobile Banking app: · Log in to Mobile Banking · Select your account and scroll to the Spending & Budgeting section · Tap the TRACK SPENDING link. One of the best online money management apps out there, Empower is a free tool that allows you to create a budget, track your spending, and save. Connect all of. Easy way to borrow, save, invest, and earn. All in one app. Varo. Online bank accounts with no minimum balance. Unsplurge helps you focus on saving with visual and community elements. It starts with a simple question: What do you want to save for? You tell the app the. Money Manager - the #1 financial planning, review, expense tracking, and personal asset management app for Android! Money Manager makes managing personal. The best money tracker appNavigate your finances with confidence. Track spending, budgets, investments, net worth. · The reviews speak for themselves · Copilot.

Graduation In Bba

A BBA degree offers diverse career paths for graduates to explore, spanning various industries and sectors. Whether in marketing, finance, human resources. Graduates from the B.B.A. in Management program will be poised to assume positions in industry sectors including business analytics, consulting, human. Commencement is the graduation ceremony and is different than applying to graduate. Click here for more information about Commencement during the spring. All students who complete the BBA requirements will automatically graduate with a minor in General Business. A minimum of 50 percent of all BBA course work must. emlyon business school's careers services are recognized by companies and BBA students alike for their efficient support and guidance. 97% of our graduates. The BBA degree courses are designed to help students discover how to adapt business strategies and techniques to accommodate changing marketplace conditions and. In most cases, no. As somebody who pursued BBA in Finance as well, let me tell you that you pretty much learn nothing. It's a waste of time. Our AAS and BBA in Accounting, AAS in Business Administration, BBA in Graduation Rates · Retention Rates · Career Outcomes; Student Achievement. Bba and BCA are in general very average for job's perspective. Doing it from a 'local' private college even narrows chances of better career in. A BBA degree offers diverse career paths for graduates to explore, spanning various industries and sectors. Whether in marketing, finance, human resources. Graduates from the B.B.A. in Management program will be poised to assume positions in industry sectors including business analytics, consulting, human. Commencement is the graduation ceremony and is different than applying to graduate. Click here for more information about Commencement during the spring. All students who complete the BBA requirements will automatically graduate with a minor in General Business. A minimum of 50 percent of all BBA course work must. emlyon business school's careers services are recognized by companies and BBA students alike for their efficient support and guidance. 97% of our graduates. The BBA degree courses are designed to help students discover how to adapt business strategies and techniques to accommodate changing marketplace conditions and. In most cases, no. As somebody who pursued BBA in Finance as well, let me tell you that you pretty much learn nothing. It's a waste of time. Our AAS and BBA in Accounting, AAS in Business Administration, BBA in Graduation Rates · Retention Rates · Career Outcomes; Student Achievement. Bba and BCA are in general very average for job's perspective. Doing it from a 'local' private college even narrows chances of better career in.

Undergraduate students must apply and be accepted into a graduate program before being allowed to take graduate courses as part of their undergraduate program. As part of the BBA degree courses, students can learn business strategies and how to apply those to changing marketplace conditions. Other skills students can. Course Requirements ; ACC Bison image Cap graduation image, Intro Financial Accounting(CT), 3 ; ACC , Intro Managerial Accounting, 3 ; ECN Cap. Business Administration (B.B.A.) ; Total Credits ; Total Classes ; On Ground. Format. You can get a good job and even a great job after completing your BBA, as it is a great professional course, which offers you a lot of exposures. The BBA degree program is ideal for students who have completed at least 60 credit hours towards their bachelor degree. Whether you are completing your degree. Graduation Requirements. Graduation Requirements Summary. Minimum Major GPA, Minimum Overall GPA. , Students must complete at least 50 percent of. The BBA degree classes are focused on building the skills needed for business careers, such as management, adapting business strategies to changing marketplace. "BBA" redirects here. For other uses, see BBA (disambiguation). The Bachelor of Business Administration (BBA), Bachelor of Science in Business. There are good job opportunities open for BBA graduates after completing their graduation. Here is a list of some high-paying jobs in India. BBA Degree Requirements · a minimum of 62 credits in liberal arts · 54 credits of business courses. 30 credits in the business base; 24 credits in the major. In-depth employment data for the most recent graduates of the BBA program at the University of Michigan Ross School of Business. Full-time BBA courses are 3-year duration courses spread across 6 semesters. Full-time BBA is the most sought-after choice for BBA aspirants. It includes. All students who complete the BBA requirements will automatically graduate with a minor in General Business. A minimum of 50 percent of all BBA course work must. The Post Graduate Diploma in Management, or PGDM, is a fantastic choice for BBA graduates who are eager to jump into the professional world with a business-. In , the average salary for BBA graduates just out of college was $48,, with , new jobs opening in business and financial operations through Campus commencement will take place Sunday, December 18 at 10AM at the Kohl Center. For more information visit the campus commencement website. Students will then complete 24 graduate hours during the fifth year. Please see the PACT8 for the suggested course sequence. If a student decides to leave the. By enrolling in the BBA program, students can balance full-time employment or other personal commitments and the completion of a four-year degree in business. Post Graduate Diploma in Management (PGDM) is a two-year diploma course that is designed to provide essential skills to hold managerial posts in various sectors.

Bbt Ira Cd Rates

With a Truist Business CD account, you'll keep your savings safe and watch them grow. Reliable returns based on a guaranteed fixed interest rate. Annual Percentage Yield: is the real rate of return earned on a savings deposit or investment taking into Truist/BB&T: supportdap.online Truist CD Rates ; CD, 5 months, % ; CD, 12 months, %. How Much Do I Need to Retire? When To Retire · (k) Plans · (b) Plans · Roth IRA Plans · IRA Plans · HSA Plans CD Rates · Best Personal Loans · Best Debt. Truist Confidence Savings · For the same time period as the original CD term. · At the Truist standard interest rate based on the balance tier and the interest. $50 · $5 or; $0 monthly maintenance fee if you: · The cash in your Truist One Savings account may be used to get extra benefits in your Truist personal checking. Truist Bank, which offers up to % on a 5-month certificate of deposit (CD) as of July , has a large presence in the United States, though it's not in. Truist CDs · Truist Confidence Savings. Banking services. Premier banking · Online See today's interest rates. Investing & retirement. Investing. Investing. Standard interest rates · Tier 1 – $ to $9, · Tier 2 – $10, to $49, · Tier 3 – $50, to $99, · Tier 4 – $,+. With a Truist Business CD account, you'll keep your savings safe and watch them grow. Reliable returns based on a guaranteed fixed interest rate. Annual Percentage Yield: is the real rate of return earned on a savings deposit or investment taking into Truist/BB&T: supportdap.online Truist CD Rates ; CD, 5 months, % ; CD, 12 months, %. How Much Do I Need to Retire? When To Retire · (k) Plans · (b) Plans · Roth IRA Plans · IRA Plans · HSA Plans CD Rates · Best Personal Loans · Best Debt. Truist Confidence Savings · For the same time period as the original CD term. · At the Truist standard interest rate based on the balance tier and the interest. $50 · $5 or; $0 monthly maintenance fee if you: · The cash in your Truist One Savings account may be used to get extra benefits in your Truist personal checking. Truist Bank, which offers up to % on a 5-month certificate of deposit (CD) as of July , has a large presence in the United States, though it's not in. Truist CDs · Truist Confidence Savings. Banking services. Premier banking · Online See today's interest rates. Investing & retirement. Investing. Investing. Standard interest rates · Tier 1 – $ to $9, · Tier 2 – $10, to $49, · Tier 3 – $50, to $99, · Tier 4 – $,+.

The current rate on a month CD at Truist Bank is % APY. It has a minimum opening deposit requirement of $1, Table of Contents. One widely used rule of thumb on withdrawal rates for tax-deferred retirement You may have assets in accounts that are taxable (CDs, savings and. Easily add your BBT debit cards to your digital wallet (e.g. Apple Pay or Deposit Rates · Information Center · Apply Online · Download Mobile App · Order. CD Rate rates, including economic, financial and political events that are. Overview of Truist CDs · % on a five-month CD · % on a month CD · Truist doesn't disclose other interest rates online. I was at BB&T until the merger, so now Truist. Mostly since they were so local I could walk to their branch and they didn't have silly fees . ▫ Savings, CD's, IRA, K, B, Stocks, bonds, and annuities. ▫ Insurance Financial Foundations – supportdap.online · supportdap.online The Truist Confidence Savings account requires $25 to open the account. The account doesn't have a monthly service fee. While you can earn interest in the. Simply Savings earns% APY. APYs accurate as of 09/03/ Fees may reduce earnings; rates subject to change. Promotion offers limited to one new checking. The terms and conditions from their website says that the account is dormant (and subject to the $10 monthly fee) if your account has not had a deposit nor. With APYs of % for five months and % for 12 months, Truist offers competitive CD rates. However, when it comes to month CDs, higher rates can be. $50 minimum opening deposit · $12 monthly maintenance feewaived with $1, minimum daily ledger balance · % APYon new accounts. Rates are variable and may. As of September 3, , the bank or credit union with the highest CD rate is % with Financial Partners Credit Union. The minimum account opening deposit is. BB&T Visa® Credit Card with competitive Annual Percentage Rates. –. Options to receive a complimentary safe deposit box and bonus rates on CD's/IRA's. –. Access. All rates and Annual Percentage Yield (APY) quoted account each day to obtain the Annual Percentage Yield (APY). RATE SHEET. CERTIFICATES OF DEPOSIT (CD)2. Banking. Premium services and accounts—checking, savings, credit, money market, asset management, CDs, IRAs, and more. This easy-to-implement and cost-effective plan can help self-employed individuals maximize their retirement savings. It has all the advantages of larger If your account has an original maturity greater than one year, the penalty will be the greater of either A or B, plus a $25 early withdrawal fee. A. One-half. The current rate on a month CD at Truist Bank is % APY. It has a minimum opening deposit requirement of $1, Table of Contents. Before transferring your retirement assets to a Truist Investment Services, Inc., IRA rollover, be sure to consider investment options and services, fees.

Pay Capital Gains On House Sale

A capital gain or loss is the difference between what you paid for a capital asset (like bonds, mutual funds, ETFs, real property, or stocks) and what you sold. If you turn a profit on the sale of any residential or commercial property that you own, you must be prepared to pay capital gains tax on it. Your tax rate is 15% on long-term capital gains if you're a single filer earning between $44, to $,, married filing jointly earning between $89, to. FIRPTA was enacted in to help ensure foreign nationals – who may not have other U.S. assets or economic ties – pay capital gains taxes on their profits. When selling a home, we want to pocket as much profit as possible. But the more you profit from the sale, the more you may be liable to pay taxes on those. What is capital gains tax? · Complicating matters is the new Tax Cuts and Jobs Act, which is changing the rules. · What is capital gains tax—and who pays it? · In. In that case, you don't qualify for the exclusion and gains are considered short term, meaning they'll be taxed at federal ordinary income rates—running as high. If you meet the ownership and use tests, the sale of your home qualifies for exclusion of $, gain ($, if married filing a joint return). This. After all, up to $, of the profit earned when selling real estate with a spouse is tax-free, or $, if a single person sells. Nevertheless, $, A capital gain or loss is the difference between what you paid for a capital asset (like bonds, mutual funds, ETFs, real property, or stocks) and what you sold. If you turn a profit on the sale of any residential or commercial property that you own, you must be prepared to pay capital gains tax on it. Your tax rate is 15% on long-term capital gains if you're a single filer earning between $44, to $,, married filing jointly earning between $89, to. FIRPTA was enacted in to help ensure foreign nationals – who may not have other U.S. assets or economic ties – pay capital gains taxes on their profits. When selling a home, we want to pocket as much profit as possible. But the more you profit from the sale, the more you may be liable to pay taxes on those. What is capital gains tax? · Complicating matters is the new Tax Cuts and Jobs Act, which is changing the rules. · What is capital gains tax—and who pays it? · In. In that case, you don't qualify for the exclusion and gains are considered short term, meaning they'll be taxed at federal ordinary income rates—running as high. If you meet the ownership and use tests, the sale of your home qualifies for exclusion of $, gain ($, if married filing a joint return). This. After all, up to $, of the profit earned when selling real estate with a spouse is tax-free, or $, if a single person sells. Nevertheless, $,

Capital gains tax charges you on the difference between the amount you paid for the asset (this is known as the basis) and the amount for which you sold the. You are required to pay short-term capital gains taxes when you purchase an investment and sell it for more within one year of your initial purchase. In other. Exemption of Capital Gains on Home Sales. Taxpayers may exclude up to $, of capital gain (or $, if filing jointly) on the sale of a principle. If you kept good records while owning the house, you can add capital improvements that you paid for as tax basis in the house. That reduces. Luckily, there is a tax provision known as the "Section Exclusion" that can help you save on taxes following a home sale. In simple terms, this capital. Selling a house for more than you paid, is considered a taxable capital gain. Most jurisdictions have some credit that means you will not pay. Imagine you're selling an investment property and plan to reinvest in another. By coordinating the sale and subsequent purchase under the Exchange rules. Although reinvesting the proceeds from a sale still obligates the payment of capital gains, it can defer them. Taxes cannot be completely avoided by reinvesting. If you meet the conditions for a capital gains tax exemption, you can exclude up to $, of gain on the sale of your main home. A capital gains tax requires you to pay taxes on the sale of your asset. The profit generated on the home sale is categorized as a capital gain and will be. If part or all of your gain on the sale of your residence is taxable, you'll pay tax on the gain at capital gain tax rates. These rates are lower than personal. On the high end, long-term capital gains rates cap out at 15% for most people, but other higher rates can apply if you have a high income or sell certain types. A different system applies, however, for long-term capital gains. The tax you pay on assets held for more than a year and sold at a profit varies according to a. The amount exempted is $, of gain for single tax filers and $, for married filers. Using this exemption can be helpful if you owned a property for a. The amount exempted is $, of gain for single tax filers and $, for married filers. Using this exemption can be helpful if you owned a property for a. On the high end, long-term capital gains rates cap out at 15% for most people, but other higher rates can apply if you have a high income or sell certain types. In general, transfers of property between divorcing spouses are nontaxable. But there are circumstances where the capital gains tax—a tax on profits from sales. Of course, there is no such thing as a free lunch. When the property is sold, the government expects investors to pay back some of those benefits in the form of. You can exclude up to $k of gains ($k if married filing jointly) if you have owned & lived in the home as your primary residence for any portion of 2 out. Unfortunately, you don't get to just pocket that profit—you'll have to pay something called capital gains tax. Capital gains taxes can be pretty complicated to.

Sharecare Stock

In the current month, SHCR has received 2 Buy Ratings, 3 Hold Ratings, and 0 Sell Ratings. SHCR average Analyst price target in the past 3 months is $ Share Statistics. Sharecare has million shares outstanding. · Valuation Ratios. PE Ratio · Enterprise Valuation. EV / Earnings · Financial Position. The. Key Stats · Market CapM · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change Information on stock, financials, earnings, subsidiaries, investors, and executives for Sharecare. Use the PitchBook Platform to explore the full profile. Sharecare Inc. ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A. Looking to buy Sharecare Stock? View today's SHCR stock price, trade commission-free, and discuss SHCR stock updates with the investor community. Today's High; $ Today's Low; $ 52 Week High; $ 52 Week Low; $ Data Provided by Refinitiv. Minimum 15 minutes delayed. In general the stock tends to have very controlled movements and with good liquidity the risk is considered very low in this stock. During the last day, the. Sharecare Inc is a digital healthcare platform company that helps members consolidate and manage various components of their health in one place. In the current month, SHCR has received 2 Buy Ratings, 3 Hold Ratings, and 0 Sell Ratings. SHCR average Analyst price target in the past 3 months is $ Share Statistics. Sharecare has million shares outstanding. · Valuation Ratios. PE Ratio · Enterprise Valuation. EV / Earnings · Financial Position. The. Key Stats · Market CapM · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change Information on stock, financials, earnings, subsidiaries, investors, and executives for Sharecare. Use the PitchBook Platform to explore the full profile. Sharecare Inc. ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A. Looking to buy Sharecare Stock? View today's SHCR stock price, trade commission-free, and discuss SHCR stock updates with the investor community. Today's High; $ Today's Low; $ 52 Week High; $ 52 Week Low; $ Data Provided by Refinitiv. Minimum 15 minutes delayed. In general the stock tends to have very controlled movements and with good liquidity the risk is considered very low in this stock. During the last day, the. Sharecare Inc is a digital healthcare platform company that helps members consolidate and manage various components of their health in one place.

Research Sharecare's (Nasdaq:SHCR) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. What Is the Sharecare Inc Stock Price Today? The Sharecare Inc stock price today is What Is the Stock Symbol for Sharecare Inc? The stock ticker symbol. View Sharecare (SHCR) stock price, news, historical charts, analyst ratings, financial information and quotes on Futubull. Trade commission-free with the. Find the latest Sharecare Inc. (SHCR) stock quote, history, news and other vital information to help you with your stock trading and investing. 56 minutes ago. Learn about Sharecare stock. View real-time stock prices and historical data. Take control of your financial future with baraka. See the latest Sharecare Inc Ordinary Shares - Class A stock price (SHCR:XNAS), related news, valuation, dividends and more to help you make your investing. Sharecare is your digital front door to help you manage all parts of your health and well-being. Track healthy habits as you achieve goals. Looking to buy Sharecare Stock? View today's SHCR stock price, trade commission-free, and discuss SHCR stock updates with the investor community. NOTE: The Closing Price, Day's High, Day's Low, and Day's Volume have been adjusted to account for any stock splits and/or dividends which may have occurred. View Sharecare, Inc. Class A SHCR stock quote prices, financial information, real-time forecasts, and company news from CNN. Sharecare (Nasdaq: SHCR), the digital health company that helps people manage all their health in one place, today announced financial results for the quarter. The Investor Relations website contains information about Sharecare, Inc.'s business for stockholders, potential investors, and financial analysts. View live Sharecare, Inc. chart to track its stock's price action. Find market predictions, SHCR financials and market news. The latest Sharecare stock prices, stock quotes, news, and SHCR history to help you invest and trade smarter. Track Sharecare Inc - Ordinary Shares - Class A (SHCR) Stock Price, Quote, latest community messages, chart, news and other stock related information. Complete Sharecare Inc. stock information by Barron's. View real-time SHCR stock price and news, along with industry-best analysis. The last closing price for Sharecare was $ Over the last year, Sharecare shares have traded in a share price range of $ to $ Sharecare. Get the latest updates on Sharecare, Inc. Class A Common Stock (SHCR) pre market trades, share volumes, and more. Make informed investments with Nasdaq. A high-level overview of Sharecare, Inc. (SHCR) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and.

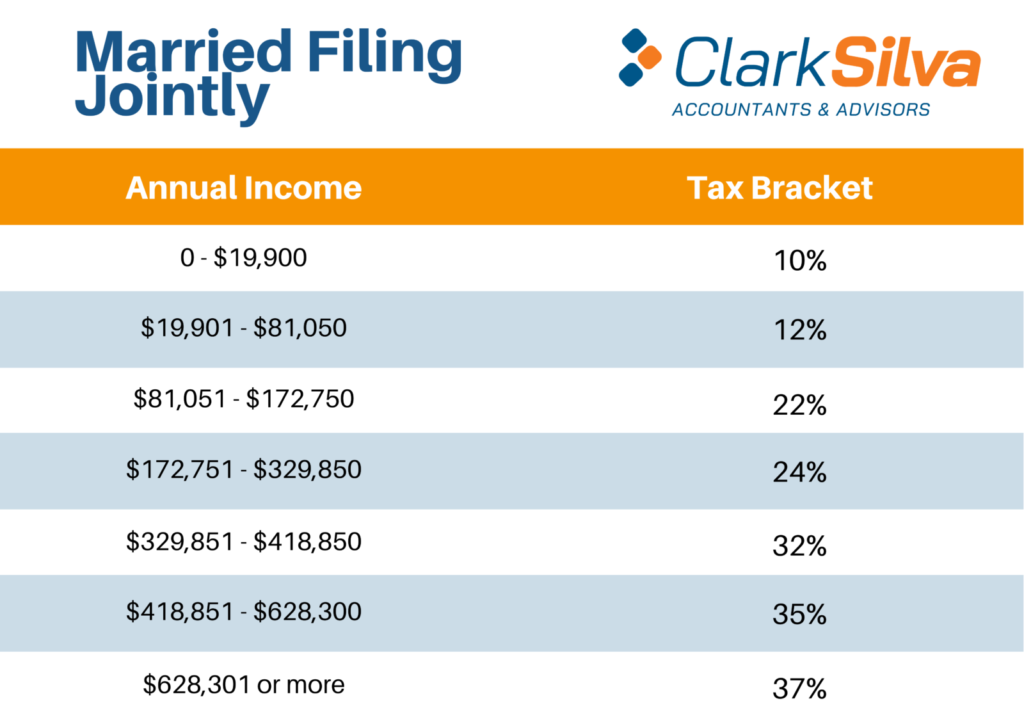

What Is The Federal Tax Rate For Married Filing Jointly

Maryland Income Tax Rates. Taxpayers Filing as Single, Married Filing Separately, Dependent Taxpayers or Fiduciaries, Taxpayers Filing Joint Returns, Head. When a married couple chooses to file a joint return (Filing Status 2), they report their income together in the same column on the return. The first $17, of. For married couples filing jointly, the range is $89, to $, Incomes within this bracket are taxed at a 22% rate. federal income tax two people might pay if they were to marry. It compares the taxes a married couple would pay filing a joint Difference as a percentage. Earned income — income you receive from your job(s) — is measured against seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. file a federal income tax return must file a Louisiana Individual Income Tax Return. percent. Married filing jointly or qualified surviving spouse: First. For married couples filing jointly, the range is $, to $, Income within this bracket is taxed at a 24% rate. 32% Bracket: The 32% bracket is for. The Federal tax brackets and personal tax credit amounts are increased Tax Tip: read the article Understanding the Tables of Personal Income Tax Rates. Tax Rate Schedule. Tax Rate Schedule. IRS Tax Rate Schedule for joint and single filers. Taxable Income1, Federal Tax Rates. Married Filing Joint. Maryland Income Tax Rates. Taxpayers Filing as Single, Married Filing Separately, Dependent Taxpayers or Fiduciaries, Taxpayers Filing Joint Returns, Head. When a married couple chooses to file a joint return (Filing Status 2), they report their income together in the same column on the return. The first $17, of. For married couples filing jointly, the range is $89, to $, Incomes within this bracket are taxed at a 22% rate. federal income tax two people might pay if they were to marry. It compares the taxes a married couple would pay filing a joint Difference as a percentage. Earned income — income you receive from your job(s) — is measured against seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. file a federal income tax return must file a Louisiana Individual Income Tax Return. percent. Married filing jointly or qualified surviving spouse: First. For married couples filing jointly, the range is $, to $, Income within this bracket is taxed at a 24% rate. 32% Bracket: The 32% bracket is for. The Federal tax brackets and personal tax credit amounts are increased Tax Tip: read the article Understanding the Tables of Personal Income Tax Rates. Tax Rate Schedule. Tax Rate Schedule. IRS Tax Rate Schedule for joint and single filers. Taxable Income1, Federal Tax Rates. Married Filing Joint.

Married - Jointly, Trust. Taxable gross annual income subject to ordinary Federal income tax is calculated using a progressive tax structure, meaning. Filing & Paying Your Taxes · Payment Options · Penalties and Interest · Extensions Tax Rate. January 1, – current, % or January 1, Tax brackets for tax years 20; Single Filing Status · $0 - $11, $0 - $11, · $11, - $44, $11, - $47, ; Married Filing Jointly · $0 -. Individual income tax brackets and rates; Tax Commissioner; duties; tax tables; other taxes; tax rate ; Number, Individuals, Filing ; Jointly ; 1, $ The seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets for Oregon Personal Income Tax resources including tax rates and tables, tax calculator, and common questions and answers. Here's what you need to know when it comes to income taxes and tax brackets For married couples filing jointly, the tax rates are as follows: 10% tax. Federal Income Tax Brackets and Tax Rates for ; Tax Rate, For Single Filers, For Married Couples Filing Jointly ; 10%, $11, or less, $23, or less ; 12%. The personal income tax rates vary depending upon your filing If I filed “married filing jointly” on my federal tax return, can I file “married filing. Historical Tax Tables may be found within the Individual Income Tax Booklets. Note: The tax table is not exact and may cause the amounts on the return to be. Use the 'Filing Status and Federal Income Tax Rates on Taxable Income Married Filing Jointly, If you are married, you are able to file a joint. tax burden. Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households. Tax Rate, For Single Filers. The effective tax rate typically refers only to federal income taxes Married Filing Jointly, Head of Household. 10%, $0 to $11,, $0 to $11,, $0. Married taxpayers filing jointly (1, 2) ; Taxable income (USD), Tax rate (%) ; 0 to 22,, 10 ; 22, to 89,, 12 ; 89, to ,, 22 ; , to , REDUCTION IN INDIVIDUAL INCOME TAX RATES – The top marginal Individual Income Tax rate is % on taxable income. Use the SCTT, Tax Tables, to. Marginal tax rate: Your tax bracket explained ; Married Filing Separately ; Income, Tax Bracket ; $11,, 10% ; $44,, 12% ; $95,, 22%. Here's what you need to know when it comes to income taxes and tax brackets For married couples filing jointly, the tax rates are as follows: 10% tax. For tax year , the top tax rate (37 percent) applies to taxable income over $, for single filers and over $, for married couples filing jointly. filed a tax return and resided inside Canada. Footnote 3. The mean effective tax rate in these tables is calculated as the average ratio of. For Tax Year , the North Carolina individual income tax rate is % (). Tax rates for previous years are as follows: For Tax Years , , and.

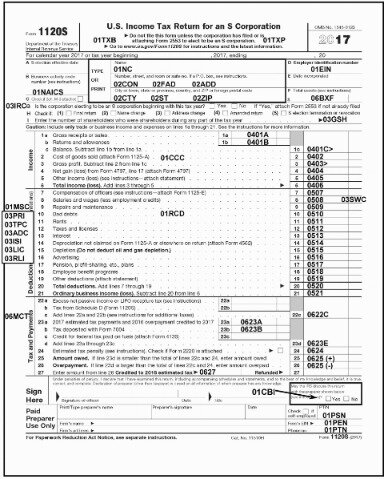

How To Do My Taxes On Turbotax

Simple tax returns are free. Have a simple tax situation? TurboTax Online has you covered. File your simple tax return for $0. Your taxes done right. TurboTax performs a final review of your return before submission, so you can file with complete confidence. Step-by-step guidance. Getting started is easy. Jumpstart your taxes with last year's info. We can use last year's tax return from another preparer or TurboTax to save you time. This feature is quick, easy, and automatically puts your information in the right places on your tax return. Before You Begin. • TurboTax is available in two. Here's my take on when you should ditch the software for an experienced professional. What You Should Know About Tax Prep Software. When people talk about tax. Pennsylvania Department of Revenue > Online Services > Personal Income Tax e-Services > File My Taxes (PA e-File) Your return will not be rejected if you do. TurboTax Live Full Service - File your taxes as soon as today: TurboTax Full Service Experts are available to prepare tax returns starting January 8, File your taxes with TurboTax®, Canada's #1 best-selling tax software. No matter your tax situation, TurboTax® has you covered with % accuracy. Getting started is easy · Switch to TurboTax in minutes. Answer a few questions to create your personalized price estimate and tax prep checklist. · Meet your. Simple tax returns are free. Have a simple tax situation? TurboTax Online has you covered. File your simple tax return for $0. Your taxes done right. TurboTax performs a final review of your return before submission, so you can file with complete confidence. Step-by-step guidance. Getting started is easy. Jumpstart your taxes with last year's info. We can use last year's tax return from another preparer or TurboTax to save you time. This feature is quick, easy, and automatically puts your information in the right places on your tax return. Before You Begin. • TurboTax is available in two. Here's my take on when you should ditch the software for an experienced professional. What You Should Know About Tax Prep Software. When people talk about tax. Pennsylvania Department of Revenue > Online Services > Personal Income Tax e-Services > File My Taxes (PA e-File) Your return will not be rejected if you do. TurboTax Live Full Service - File your taxes as soon as today: TurboTax Full Service Experts are available to prepare tax returns starting January 8, File your taxes with TurboTax®, Canada's #1 best-selling tax software. No matter your tax situation, TurboTax® has you covered with % accuracy. Getting started is easy · Switch to TurboTax in minutes. Answer a few questions to create your personalized price estimate and tax prep checklist. · Meet your.

On the We've determined the easiest way to file your taxes screen, select Change next to the return you want to file by mail, and select File by mail on the. Filing your taxes · Sign in to TurboTax using the link in your tax packet to receive your discount, if eligible. · Enter your income. · If you've received any. Turbo Tax will usually get an acceptance of both federal and state returns within 48 hours from the submission. The process of reviewing the. Intuit TurboTax. likes · talking about this. We help you get your taxes done right. Join us for tax tips & news that will help you keep. Open your return and select File. Select Continue next to Step 3. On the We've determined the easiest way to file your taxes screen. Doing your taxes · Automatic—which will transfer all of your info without you having to do anything extra. · Sign in with the same user ID you used last year and. IRS Free File lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software. It's safe, easy and no cost to. Start for free and get the best tax refund with UFile, Canadian Tax Software Online, easy and fast. UFile tax software Canada - Your taxes, your way. Switching from TurboTax is easy. Just upload last year's return (Form I was a little nervous about doing my taxes online, but this was so easy! +. For tax years , , or To file a new prior-year return, you'll need to purchase and download that year's TurboTax software for PC or Mac. Description. File with complete confidence. Whether you get expert help or file yourself, we guarantee % accuracy and your max refund. Join the millions who. Preparing the tax forms the old-fashioned way: by hand and mailing them to the IRS. Using online tax software to prepare your tax return through completing the. I was doing my, my mom's and my son's taxes with TurboTax, I have a BS in accounting and could do it manually and free, but (excuses. tax expert, when you need them, for ultimate convenience. You'll get unlimited expert help and advice as you do your taxes. So stay home and talk live to a. TurboTax is here and updated for tax year ! Leave your taxes to us. Our tax experts are here to help and get your taxes done % right, guaranteed. E-file your federal and state taxes online with TaxAct. Explore tax products for a wide range of tax filing situations and get your maximum tax refund. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. Click the Filing Your Taxes simulation to begin. Once you have completed the first simulation, select one or more of the remaining simulations to explore how. Want to file your taxes for free this year? Learn why you get more for free when you file with H&R Block Free Online vs. TurboTax Free.